Vt Property Transfer Tax Rate . vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. vermont's current transfer tax rate is usually up to $1.45 per $100. Some cities and counties also charge their own transfer taxes. This rate includes the increased clean water surcharge. For values exceeding $200,000, the tax rate will be 1.47%. property transfer tax reports. So, for a house worth $400,462 — the median home price in the state — the transfer tax due will be $4,827. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the previous $100,000 threshold. These reports contain information on property sales by town and property category. effective august 1, 2024, the property transfer tax rates are as follows: Remains the same at 1.25%.

from www.templateroller.com

Some cities and counties also charge their own transfer taxes. This rate includes the increased clean water surcharge. For values exceeding $200,000, the tax rate will be 1.47%. vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. vermont's current transfer tax rate is usually up to $1.45 per $100. These reports contain information on property sales by town and property category. property transfer tax reports. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the previous $100,000 threshold. Remains the same at 1.25%. So, for a house worth $400,462 — the median home price in the state — the transfer tax due will be $4,827.

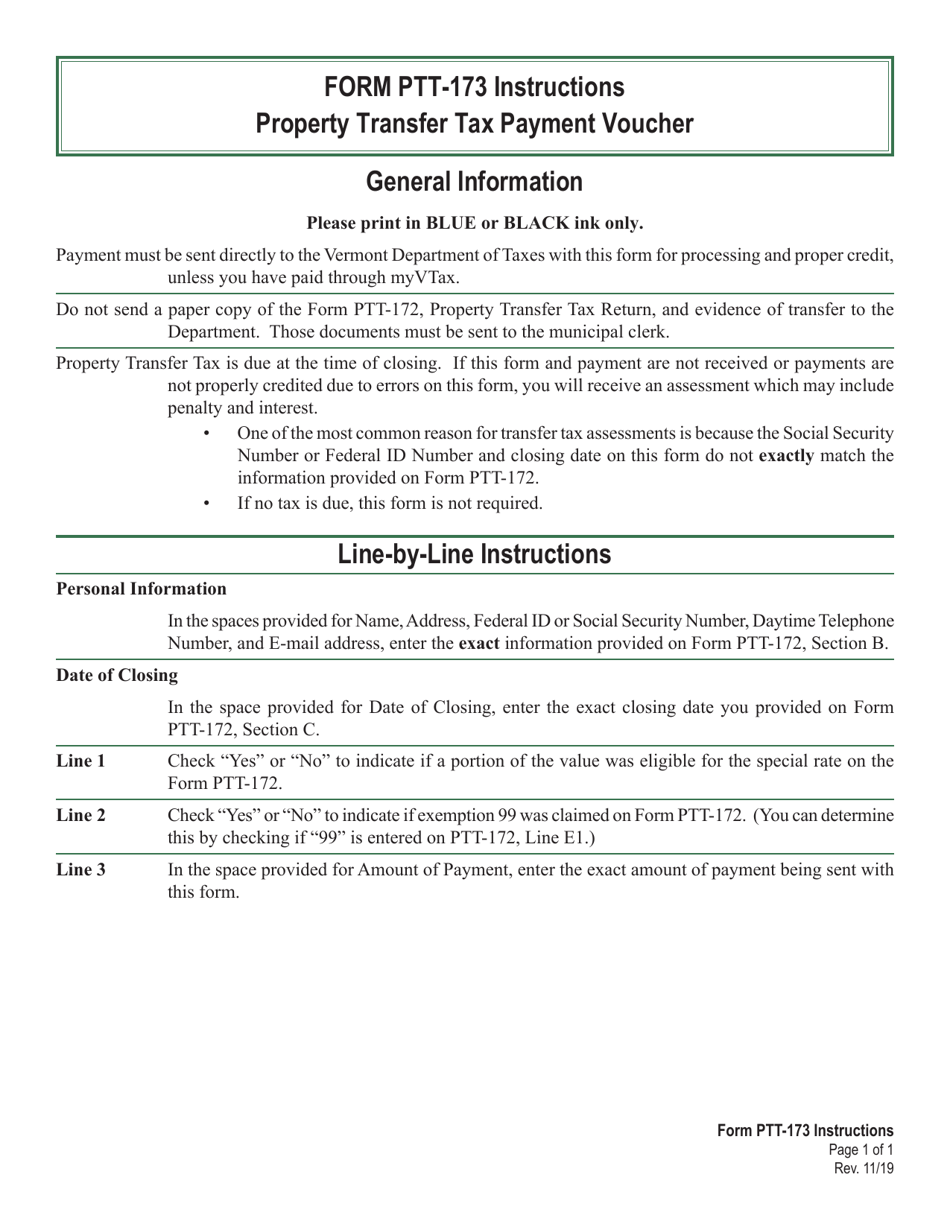

Download Instructions for VT Form PTT173 Property Transfer Tax Payment

Vt Property Transfer Tax Rate the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the previous $100,000 threshold. vermont's current transfer tax rate is usually up to $1.45 per $100. Some cities and counties also charge their own transfer taxes. property transfer tax reports. These reports contain information on property sales by town and property category. vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. effective august 1, 2024, the property transfer tax rates are as follows: So, for a house worth $400,462 — the median home price in the state — the transfer tax due will be $4,827. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the previous $100,000 threshold. This rate includes the increased clean water surcharge. Remains the same at 1.25%. For values exceeding $200,000, the tax rate will be 1.47%.

From www.templateroller.com

Download Instructions for Form PTT172 Vermont Property Transfer Tax Vt Property Transfer Tax Rate vermont's current transfer tax rate is usually up to $1.45 per $100. These reports contain information on property sales by town and property category. Remains the same at 1.25%. vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. the transfer tax will be imposed at a reduced rate of 0.5% on. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for VT Form PTT172 Property Transfer Tax Return Vt Property Transfer Tax Rate So, for a house worth $400,462 — the median home price in the state — the transfer tax due will be $4,827. Some cities and counties also charge their own transfer taxes. This rate includes the increased clean water surcharge. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's. Vt Property Transfer Tax Rate.

From www.xoatax.com

Vermont Property Tax Rates Highlights 2024 Vt Property Transfer Tax Rate This rate includes the increased clean water surcharge. Some cities and counties also charge their own transfer taxes. These reports contain information on property sales by town and property category. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the previous $100,000 threshold. vermont's current. Vt Property Transfer Tax Rate.

From www.templateroller.com

VT Form PTT172 Download Printable PDF or Fill Online Vermont Property Vt Property Transfer Tax Rate property transfer tax reports. vermont's current transfer tax rate is usually up to $1.45 per $100. Remains the same at 1.25%. effective august 1, 2024, the property transfer tax rates are as follows: These reports contain information on property sales by town and property category. So, for a house worth $400,462 — the median home price in. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for VT Form PTT173 Property Transfer Tax Payment Vt Property Transfer Tax Rate Some cities and counties also charge their own transfer taxes. vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. effective august 1, 2024, the property transfer tax rates are as follows: the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value,. Vt Property Transfer Tax Rate.

From www.templateroller.com

VT Form PTT172 Fill Out, Sign Online and Download Printable PDF Vt Property Transfer Tax Rate These reports contain information on property sales by town and property category. This rate includes the increased clean water surcharge. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the previous $100,000 threshold. Remains the same at 1.25%. effective august 1, 2024, the property transfer. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for VT Form PTT172 Property Transfer Tax Return Vt Property Transfer Tax Rate vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. property transfer tax reports. These reports contain information on property sales by town and property category. effective august 1, 2024, the property transfer tax rates are as follows: Remains the same at 1.25%. For values exceeding $200,000, the tax rate will be. Vt Property Transfer Tax Rate.

From www.templateroller.com

VT Form PTT172 Download Printable PDF or Fill Online Vermont Property Vt Property Transfer Tax Rate Remains the same at 1.25%. vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. These reports contain information on property sales by town and property category. effective august 1, 2024, the property transfer tax rates are as follows: So, for a house worth $400,462 — the median home price in the state. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for Form PTT172 Vermont Property Transfer Tax Vt Property Transfer Tax Rate This rate includes the increased clean water surcharge. vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. For values exceeding $200,000, the tax rate will be 1.47%. property transfer tax reports. So, for a house worth $400,462 — the median home price in the state — the transfer tax due will be. Vt Property Transfer Tax Rate.

From www.formsbank.com

Fillable Form Pt172 Property Transfer Tax Return Vermont printable Vt Property Transfer Tax Rate These reports contain information on property sales by town and property category. For values exceeding $200,000, the tax rate will be 1.47%. vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for Form PTT172 Vermont Property Transfer Tax Vt Property Transfer Tax Rate property transfer tax reports. effective august 1, 2024, the property transfer tax rates are as follows: For values exceeding $200,000, the tax rate will be 1.47%. This rate includes the increased clean water surcharge. These reports contain information on property sales by town and property category. So, for a house worth $400,462 — the median home price in. Vt Property Transfer Tax Rate.

From www.templateroller.com

VT Form PTT172 Download Fillable PDF or Fill Online Vermont Property Vt Property Transfer Tax Rate So, for a house worth $400,462 — the median home price in the state — the transfer tax due will be $4,827. property transfer tax reports. Remains the same at 1.25%. vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. This rate includes the increased clean water surcharge. Some cities and counties. Vt Property Transfer Tax Rate.

From www.templateroller.com

VT Form PTT172 Download Fillable PDF or Fill Online Vermont Property Vt Property Transfer Tax Rate property transfer tax reports. This rate includes the increased clean water surcharge. Some cities and counties also charge their own transfer taxes. vermont's current transfer tax rate is usually up to $1.45 per $100. effective august 1, 2024, the property transfer tax rates are as follows: vermont imposes a clean water surcharge on property transfers subject. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for VT Form PTT172 Property Transfer Tax Return Vt Property Transfer Tax Rate vermont's current transfer tax rate is usually up to $1.45 per $100. So, for a house worth $400,462 — the median home price in the state — the transfer tax due will be $4,827. This rate includes the increased clean water surcharge. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for VT Form PTT172 Property Transfer Tax Return Vt Property Transfer Tax Rate This rate includes the increased clean water surcharge. For values exceeding $200,000, the tax rate will be 1.47%. Remains the same at 1.25%. Some cities and counties also charge their own transfer taxes. So, for a house worth $400,462 — the median home price in the state — the transfer tax due will be $4,827. These reports contain information on. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for VT Form PTT172 Property Transfer Tax Return Vt Property Transfer Tax Rate Remains the same at 1.25%. effective august 1, 2024, the property transfer tax rates are as follows: vermont imposes a clean water surcharge on property transfers subject to the property transfer tax. property transfer tax reports. These reports contain information on property sales by town and property category. This rate includes the increased clean water surcharge. So,. Vt Property Transfer Tax Rate.

From www.templateroller.com

Download Instructions for VT Form PTT172 Property Transfer Tax Return Vt Property Transfer Tax Rate vermont's current transfer tax rate is usually up to $1.45 per $100. effective august 1, 2024, the property transfer tax rates are as follows: Some cities and counties also charge their own transfer taxes. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the. Vt Property Transfer Tax Rate.

From www.templateroller.com

VT Form PTT172 Fill Out, Sign Online and Download Printable PDF Vt Property Transfer Tax Rate property transfer tax reports. These reports contain information on property sales by town and property category. For values exceeding $200,000, the tax rate will be 1.47%. This rate includes the increased clean water surcharge. the transfer tax will be imposed at a reduced rate of 0.5% on the first $200,000 of the property's value, up from the previous. Vt Property Transfer Tax Rate.